Cost & Financing

- Room Rates

- Deposit Policy

- Settlement of Accounts

- Billing & Insurance

- FAQ

Mount Alvernia Hospital collects a deposit upon admission for most cases. The deposit will be used to offset the charges incurred during your hospital stay.

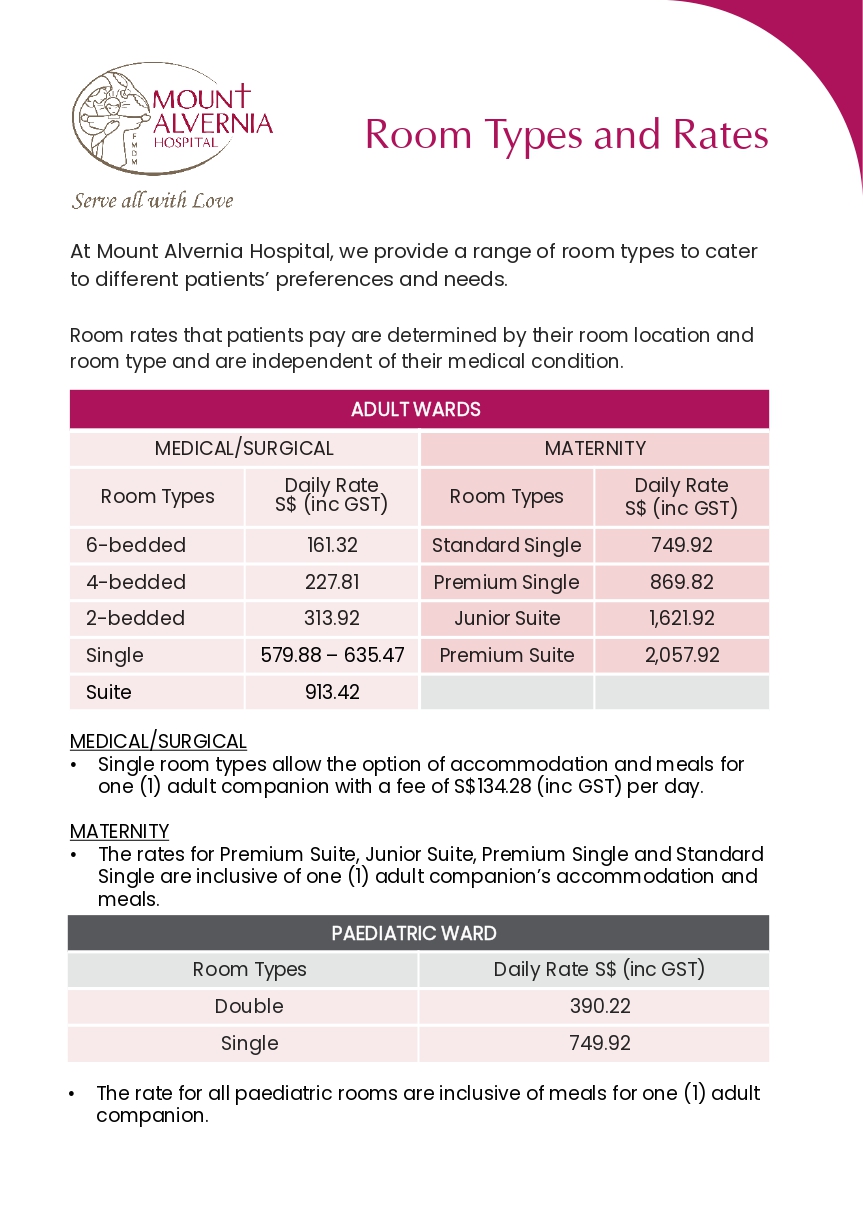

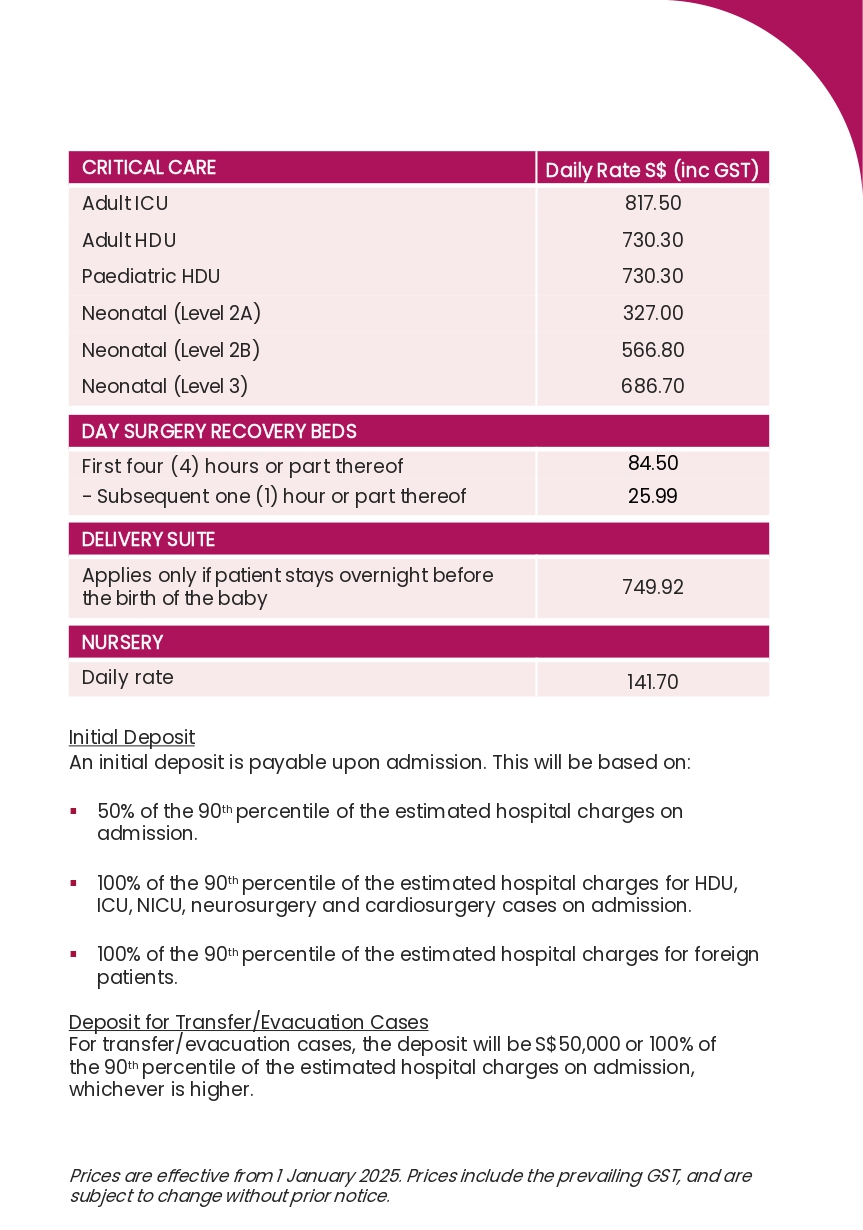

Initial Deposit

An initial deposit is payable upon admission. This will be based on:

- 50% of the 90th percentile of the estimated hospital charges on admission.

- 100% of the 90th percentile of the estimated hospital charges for neurosurgery, cardiosurgery, HDU, ICU, NICU cases and foreign patients.

Deposit For Transfer / Evacuation Cases

For transfer/evacuation cases, the deposit will be $50,000 or 100% of the 90th percentile of the estimated hospital charges on admission, whichever is higher.

Deposit For Maternity Cases

For maternity cases, the deposit will depend on the type of delivery package. Please click here for details.

Refund of Deposit

If the deposit is more than the Final Bill size, it will be refunded to you by cheque after your discharge. Otherwise, you will need to top up the balance.

Interim progress payment will be requested during your stay.

Payment mode

You may make payment by cash, cheque, credit cards or NETS at our Business Office (open 24 hours every day).

Medisave

You may also use the Medisave fund (subject to maximum claimable from CPF Board) to settle the hospital bills for yourself, your spouse, siblings, parents or children. Should you wish to use Medisave for your grandparents, you may do so provided they are Singaporeans or Permanent Residents. For further information on Medisave, please consult our staff at the Business Office.

Medical insurance

If you are covered by medical insurance, our Medical Records Office will be pleased to liaise with your attending Doctor in completing your claim forms.

Company

If your company is registered with our hospital for credit facilities, please present a Letter of Guarantee from your employer. This letter exempts you from paying a deposit on admission.

Use of Medisave Account

Medisave can be used to cover hospitalization and day surgery expenses. However, it does not cover outpatient expenses except for treatments approved by the Ministry of Health.

There is a limit on the amount claimable from Medisave. They are as follows:

| Medisave Withdrawal Limit | |

| Inpatient | Up to $1,130 per day for the first two days of admission and $400 per day from the third day onwards for inpatient daily hospital charges |

| Day Surgery | Up to $830 per day for daily hospital charges |

| Inpatient psychiatric treatment | Up to $1,130 per day for the first two days of admission and $230 per day from the third day onwards for daily hospital charges |

| Surgical operations (inpatient and day surgery) |

A fixed limit ranging from $240 to $5,290 can be used (depending on the complexity of the operation according to MOH’s Table of Surgical Procedures). |

To learn more, you can visit the MOH website.

- What is a Medisave-Approved Integrated Shield Plan (IP)?

From 1 Nov 2015, all Singapore Citizens and Permanent Residents are covered under MediShield Life – a basic national health insurance plan administered by Central Provident Fund (CPF) Board. As its coverage is meant for subsidised treatment in public hospitals, CPF members who wish to enjoy additional private insurance coverage can also use their Medisave savings to purchase Medisave-approved IPs.

Coverage for each IP may differ as it depends on the benefits that you have chosen. Participating insurers for IPs are as follows:

- AlA Singapore Private Limited

- Great Eastern Life Assurance Co

- HSBC Life (Singapore) Pte. Ltd.

- Income Insurance Limited

- Prudential Assurance Co

- Raffles Health Insurance

- Singapore Life Ltd.

For more information on MediShield Life and IPs, click here

- How do I know if I have an IP covered for private hospitalisation?

You may contact your insurer prior to your admission to clarify if your IP can cover you for private hospitalisation. At the point of admission, our Business Office staff can also assist you in checking whether you have an IP after getting your authorisation on the Medical Claims Authorisation Form (MCAF).

- If I have an IP, do I need to make any upfront payment for my hospitalisation?

Admission

If you have an IP, our Business Office staff will assist you to apply for an eLOG (Letter of Guarantee for Waiver of Deposit)* after getting your authorisation. If you are eligible for an eLOG and the amount is sufficient to cover the deposit required, no upfront payment is required.

When Your Stay is Extended

We can also help to apply for additional eLOG (applicable to certain insurers only)*. Similarly, no top-up deposit is required if the additional eLOG amount is sufficient to cover the revised estimated bill size.

On Your Discharge Day

We will re-apply the eLOG if the actual bill size is more than the initial estimation. Payment is required if your eLOG application is unsuccessful or the amount is insufficient to cover the balance payable.

In summary, all IPs are on reimbursement basis. If your eLOG amount covers the deposit/ balance payable, you would not need to make any upfront payment to the Hospital.

- Can I check whether I am entitled to eLOG and the guaranteed amount before the actual day of admission?

We will be able to assist you to apply for an eLOG, if you have an IP with the following insurers:

- AIA Singapore Private Limited: 14 days before your admission date

- Income Insurance Limited: 30 days before your admission date

- Prudential Assurance Co: 21 days before your admission date

- Singapore Life Ltd.: 14 days before your admission date

- What can I do if my request for eLOG is declined?

You should contact your insurer directly to clarify your policy benefits and entitlement.

- How do I claim from my IP?

We will submit# your claim electronically after your discharge. After assessing the amount payable, your private insurer will pay us direct. You will receive a final bill indicating the approved claims in approximately two to four weeks’ time.

- How do I know whether I have a refund or balance outstanding after my discharge?

If you made payment during your stay and your insurer covers the bill fully, a refund cheque will be sent to you together with the final bill. However, if partial or no payment was made during your stay (depending on the eLOG amount)*, and the claim payout is insufficient to cover the full bill, you would need to settle the outstanding balance.

- After claiming from my IP, can I still claim from my company insurance?

If your bill has been submitted to your IP insurer, you can submit your claims to your company insurer after receiving the final bill from us. Your company insurer will then reimburse to your IP accordingly, where applicable.

- Is the issuance of the eLOG an admission of any claim liability and/ or claim approval by my insurer?

Issuance of eLOG does not mean that your insurer has approved the claim. The final payout is subject to their review and assessment when the Hospital submits the claim after your discharge. The actual payout may deviate from the eLOG amount issued during your stay. You may wish to approach your insurer for their professional advice pertaining to your policies and claim payout.

- Who can I contact for further information pertaining to my policy?

You may contact your insurer directly for their advice should you need further information pertaining to your policy or coverage.

* Approvals for eLOG/ additional eLOG are subject to patients’ policies and insurers’ terms and conditions. There is generally a maximum limit for eLOG, and the amount varies across different insurers.

# For inpatients, a minimum stay of 8 hours is required for claims to be submitted by the hospital.

MEDISAVE

- What can Medisave be used for?

See https://www.moh.gov.sg/content/moh_web/home/costs_and_financing/schemes_subsidies/medisave/Withdrawal_Limits.html

Medisave can be used for the following hospital charges:

- Daily ward charges

- Doctor’s fees

- Surgical operations including the use of operating theatres; and in-patient charges for medical treatment, investigations, medicines, rehabilitation services, medical supplies, implants and prostheses introduced during surgery

Note: For a hospitalisation claim, the patient must have stayed in the hospital for at least 8 hours (unless the patient is admitted for day surgery).

- How do I use Medisave to pay for the hospital bill?

You need to give authorization to the Business Office to deduct from Medisave. The form can be obtained from the Business Office. If you are a Singapore Citizen / PR, you need to produce your NRIC. If you are a foreigner, you need to give us your CPF Membership number.

- Who can I use my Medisave for?

Medisave can be used for yourself or your immediate family members who include your spouse, siblings, children, parents and grandparents. They can be of any nationality, except for grandparents who must be Singapore Citizens or Permanent Residents.

- How much of Medisave can be used to cover the hospital bill?

Medisave can be claimed for the following and only if you are hospitalised for a minimum of 8 hours (except for day surgery).

| Medisave Withdrawal Limit | |

| Inpatient | Up to $1,130 per day for the first two days of admission and $400 per day from the third day onwards for inpatient daily hospital charges |

| Day Surgery | Up to $830 per day for daily hospital charges |

| Inpatient psychiatric treatment | Up to $1,130 per day for the first two days of admission and $230 per day from the third day onwards for daily hospital charges |

| Surgical operations (inpatient and day surgery) | A fixed limit ranging from $240 to $5,290 can be used (depending on the complexity of the operation according to MOH’s Table of Surgical Procedures). |

To learn more, you can visit MOH website.

- Can Medisave cover for pre-delivery expenses?

Yes. You are allowed to claim an additional $900 from Medisave for antenatal care if you submit your antenatal receipts to us during admission. This will be used to offset your hospital charges.

BILLING

- Hospital Bill Size

You will be given financial counselling on the estimated hospital bill upon your admission. Your actual bill will depend on the type of accommodation, estimated length of stay, diagnosis, type of operation and procedures ordered by your doctor upon admission.

For deliveries, please check our maternity package details in the Maternity Care Services brochure or online at https://mtalvernia.sg/maternity/maternity-tour-and-packages/.

- What you are paying for

A typical hospital bill may include accommodation, laboratory tests, diagnostic imaging services, use of the operating theatre, equipment usage, medicines, nursing services, doctors’ professional fees and anaesthetists’ fees.

- Modes of payment

Payment at Business Office (open 24 hours every day): By cash, cheque, NETS and major credit cards.

Funds transfer via ATM and Internet Banking: You may obtain our bank account number from our staff at the Business Office for funds transfer. However you need to inform our staff the bill number and the amount you are paying after you have done the transfer in order for us to update your records.

DEPOSITS

Deposit upon admission

An initial deposit is payable upon admission. This will be based on

- 50% of the 90th percentile of the estimated hospital charges on admission

- 80% of the 90th percentile of the estimated charges for Neurosurgery, Cardiosurgery, HDU, ICU and NICU cases on admission

- 100% of the 90th percentile of the estimated hospital charges on admission (for foreign patients)

Deposit for transfer / evacuation cases

For transfer/ evacuation cases, the deposit will be $50,000 or 80% of the 90th percentile of the estimated hospital charges on admission, whichever is higher.

Deposit for Maternity Cases

For maternity cases, the deposit will depend on the type of delivery package. Please check our maternity package details in the Maternity Care Services brochure or online at https://mtalvernia.sg/maternity/maternity-tour-and-packages/.

Refund Of Deposit

The deposit will be used to offset your hospital bill. If the deposit is more than the final bill size, the Hospital will refund you by cheque after your discharge. Otherwise, you will need to top up the balance.

FINAL BILL

If you are claiming from Medisave or paying the bill fully by cash, you will receive the final bill within 10 days from the day you are discharged from hospital. If you are claiming from MediShield Life/ Integrated Shield Plan, the final bill will only be sent to you after all claims are processed, which takes about 1 month. Please note that processing of claims may take longer if the insurer requires clarifications on the medical claims.

BIRTH REGISTRATION SERVICES

Via the LifeSG app

If you or your spouse is a Singapore citizen, both have SingPass accounts and your marriage is registered in Singapore, you may use the LifeSG app to register your child’s birth.

Please visit https://www.life.gov.sg/#ways-we-help for more information on this service or download the app to use the service.

Download

Register for a CDA account

You can register for a Child Development Account with our partner POSB here.

Go for baby blessing

We would love to conduct baby blessing for your little ones at our chapel. It is available for every newborn regardless of race, nationality or religion. Interested couples to contact our ward staff to arrange a suitable time.

BABY BONUS APPLICATION SERVICE

You may apply for this via the Life SG app at the same time when you register the birth of your child. Otherwise, you can apply online at https://www.babybonus.msf.gov.sg using your Singpass account. Please make sure that you have the following documents ready to complete application:

- Bank Account Holder’s account details to receive the cash gift

- Personal particulars of the Bank Account Holder and CDA Trustee if they are a third party (i.e. not the child’s parent)

- Adoption order and Schedule (if your child is adopted)

- Marriage Certificate (for overseas marriages)

For more information, please visit the official website at https://www.babybonus.msf.gov.sg