Medisave-Approved

Integrated Shield Plan

Mount Alvernia Hospital accepts the use of Integrated Shield Plans (IPs) from Medisave-approved insurance for bill financing. Learn more about Integrated Shield Plans below.

For any further queries, feel free to contact our Business Office at 6347 6600 or drop an email to [email protected].

1. What is a Medisave-Approved Integrated Shield Plan (IP)?

From 1 Nov 2015, all Singapore Citizens and Permanent Residents are covered under MediShield Life – a basic national health insurance plan administered by Central Provident Fund (CPF) Board. As its coverage is meant for subsidised treatment in public hospitals, CPF members who wish to enjoy additional private insurance coverage can also use their Medisave savings to purchase Medisave-approved IPs.

Coverage for each IP may differ as it depends on the benefits that you have chosen. Participating insurers for IPs are as follows:

- AlA Singapore Private Limited

- AXA Life Insurance

- Great Eastern Life Assurance Co

- Income Insurance Limited

- Prudential Assurance Co

- Raffles Health Insurance

- Singapore Life Ltd.

For more information on MediShield Life and IPs, click here.

2. How do I claim from Medisave-Approved Integrated Shield Plan?

You may contact your insurer prior to your admission to clarify if your IP can cover you for private hospitalisation. At the point of admission, our Business Office staff can also assist you in checking whether you have an IP after getting your authorisation on the Medical Claims Authorisation Form (MCAF).

3. If I have an IP, do I need to make any upfront payment for my Hospitalisation?

Admission

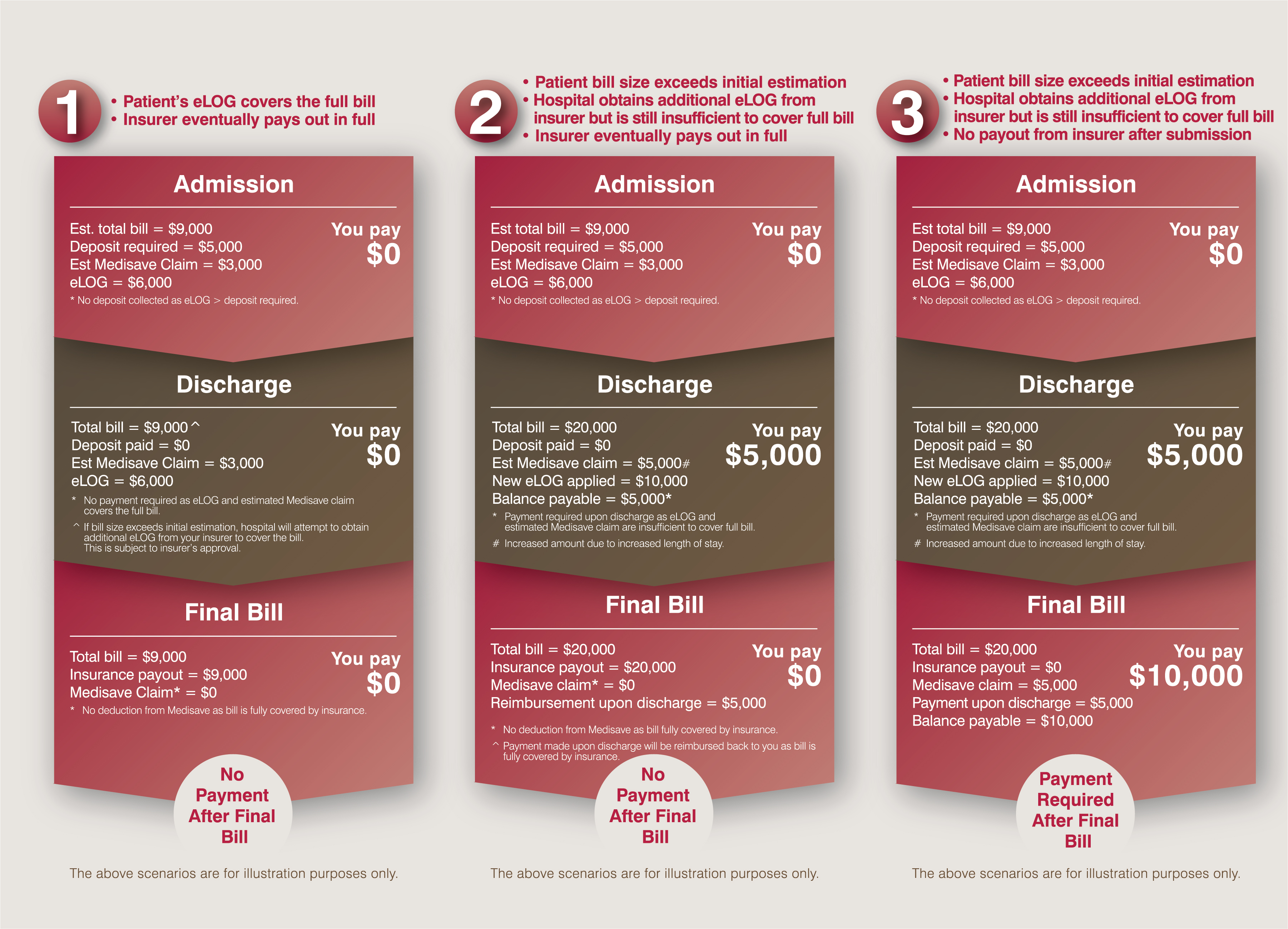

If you have an IP, our Business Office staff will assist you to apply for an eLOG (Letter of Guarantee for Waiver of Deposit)* after getting your authorisation. If you are eligible for an eLOG and the amount is sufficient to cover the deposit required, no upfront payment is required.

When Your Stay is Extended

We can also help to apply for additional eLOG (applicable to certain insurers only)*. Similarly, no top-up deposit is required if the additional eLOG amount is sufficient to cover the revised estimated bill size.

On Your Discharge Day

We will re-apply the eLOG if the actual bill size is more than the initial estimation. Payment is required if your eLOG application is unsuccessful or the amount is insufficient to cover the balance payable.

In summary, all IPs are on reimbursement basis. If your eLOG amount covers the deposit/ balance payable, you would not need to make any upfront payment to the Hospital.

* Approvals for eLOG/additional eLOG are subject to patients’ policies and insurers’ terms and conditions. There is generally a maximum limit for eLOG, and the amount varies across different insurers.

4. Can I check whether I am entitled to eLOG and the guaranteed amount before the actual day of admission?

We will be able to assist you to apply for an eLOG, if you have an IP with the following insurers:

- AIA Singapore Private Limited: 14 days before your admission date

- Income Insurance Limited: 30 days before your admission date

- Prudential Assurance Co: 21 days before your admission date

- Singapore Life Ltd.: 14 days before your admission date

With the information, you may then prepare the necessary deposit/ payment (if required) on the actual admission day.

5. What can I do if my request for eLOG is declined?

You should contact your insurer directly to clarify your policy benefits and entitlement.

6. How do I claim from my IP?

We will submit* your claim electronically after your discharge. After assessing the amount payable, your private insurer will pay us direct. You will receive a final bill indicating the approved claims in approximately two to four weeks’ time.

* For inpatients, a minimum stay of 8 hours is required for claims to be e-filed

7. How do I know whether I have a refund or balance outstanding after my discharge?

If you made payment during your stay and your insurer covers the bill fully, a refund cheque will be sent to you together with the final bill. However, if partial or no payment was made during your stay (depending on the eLOG amount)*, and the claim payout is insufficient to cover the full bill, you would need to settle the outstanding balance.

8. After claiming from my IP, can I still claim from my company insurance?

If your bill has been submitted to your IP insurer, you can submit your claims to your company insurer after receiving the final bill from us. Your company insurer will then reimburse to your IP accordingly, where applicable.

9. Is the issuance of the eLOG an admission of any claim liability and / or claim approval by my insurer?

Issuance of eLOG does not mean that your insurer has approved the claim. The final payout is subject to their review and assessment when the Hospital submits the claim after your discharge. The actual payout may deviate from the eLOG amount issued during your stay. You may wish to approach your insurer for their professional advice pertaining to your policies and claim payout.

10. Who can I contact for further information pertaining to my policy?

You may contact your insurer directly for their advice should you need further information pertaining to your policy or coverage.

Forbetter understanding, you may refer to the following illustrated scenarios: